Metro 2 software is a powerful tool used for credit reporting. It follows the Metro 2 format, a standard the Consumer Data Industry Association (CDIA) created. This format ensures accurate and consistent reporting of consumer credit information. Metro 2 software is used by numerous businesses – banks, and lenders included – to report customer credit data directly to credit bureaus, helping maintain records with minimal errors while adhering to industry regulations. It helps keep customer histories organized for easy reference while helping keep up compliance. Understanding Metro 2 can help businesses improve credit reporting efficiency and accuracy.

Why Metro 2 Software is Important

Metro 2 software is essential for businesses that report credit data. Metro 2 ensures compliance with industry regulations while reducing risks of errors, providing accurate reporting that helps maintain consumer credit scores while decreasing disputes. Users of Metro 2 can submit information directly to major credit bureaus like Equifax, Experian, and TransUnion using Metro 2. Companies using this software can streamline credit reporting procedures while avoiding legal issues and improving operational efficiencies – plus, data is formatted correctly so credit bureaus can process and analyze it quickly.

Key Features of Metro 2 Software

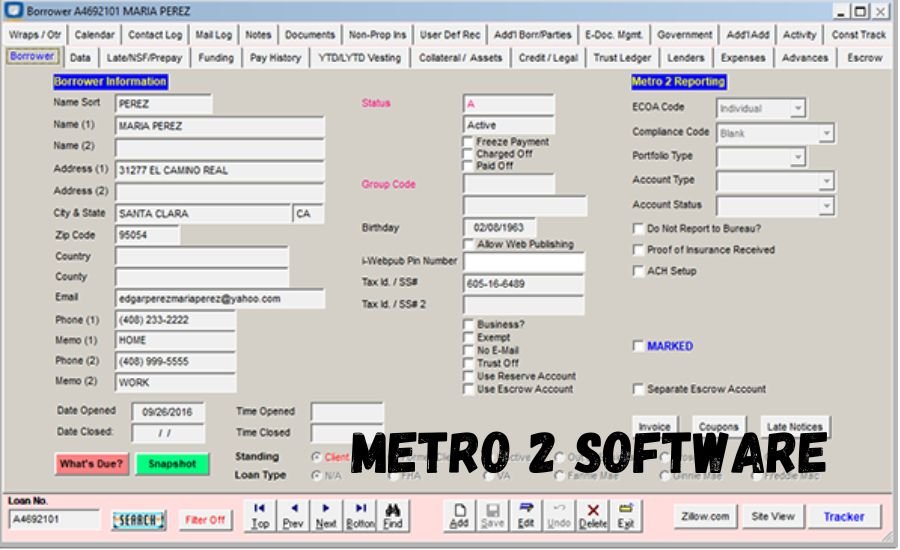

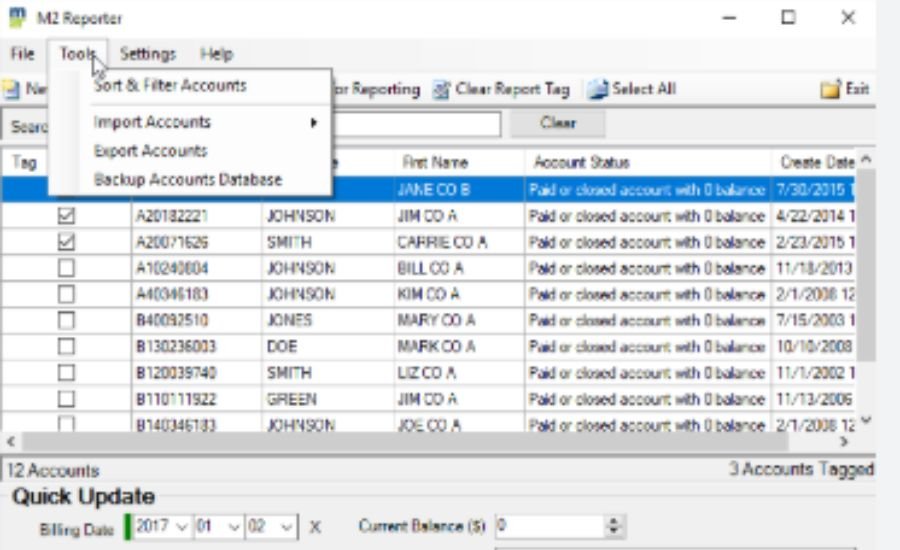

Metro 2 software comes with several features that make credit reporting easier. It includes data validation tools that check for errors before submission. This reduces the chances of incorrect credit reports. Metro 2 also provides compliance monitoring capabilities to ensure businesses comply with industry regulations and automation capabilities that simplify managing large volumes of credit data. Users can generate reports, track historical data, and integrate with other financial systems. These features help businesses save time and maintain accurate records.

How Metro 2 Software Improves Credit Reporting Accuracy

Accuracy is crucial in credit reporting, and Metro 2 ensures data integrity. The software verifies all information before submission, reducing human errors. It also provides built-in compliance checks that align with the latest industry standards. Using Metro 2 software, businesses can minimize customer disputes regarding incorrect credit reports. The software enables real-time data correction, ensuring that only accurate information reaches credit bureaus. With Metro 2 software, businesses can improve their credit reporting reliability and maintain strong relationships with credit bureaus.

Who Can Benefit from Metro 2 Software?

Many businesses can benefit from Metro 2. Metro 2 has long been used by credit unions, banks, ers, companies, collectors, mortgages, and precise reports to produce credit. Leasing and mortgage companies depend heavily on it to manage customer information more efficiently. Any organization that reports credit information to bureaus can benefit from this software. It simplifies the credit reporting process and ensures compliance with industry standards. Businesses looking to improve their credit data accuracy and efficiency should consider using Metro 2 software.

Compliance and Security in Metro 2 Software

Compliance and security are critical in credit reporting. Metro 2 software follows strict guidelines set by the CDIA. Metro 2 businesses report credit data securely and in a standardized format, using encryption features to secure sensitive information. Metro 2 meets regulations like the Fair Credit Reporting Act (FCRA) and the Gramm-Leach-Bliley Act (GLBA), giving businesses using Metro 2 peace of mind knowing their personal information is protected according to applicable rules and regulations in their field.

Metro 2 Software vs. Traditional Credit Reporting Methods

Traditional credit reporting methods often involve manual data entry, increasing the risk of errors. Metro 2 streamlines this process to reduce mistakes and boost efficiency, unlike traditional methods, which rely on manual data entry methods that result in non-standardized files for credit bureaus to process—businesses using Metro 2 experience fewer disputes and better data accuracy. The software also offers advanced features such as automated compliance tracking, making it superior to manual credit reporting methods.

How to Choose the Right Metro 2 Software

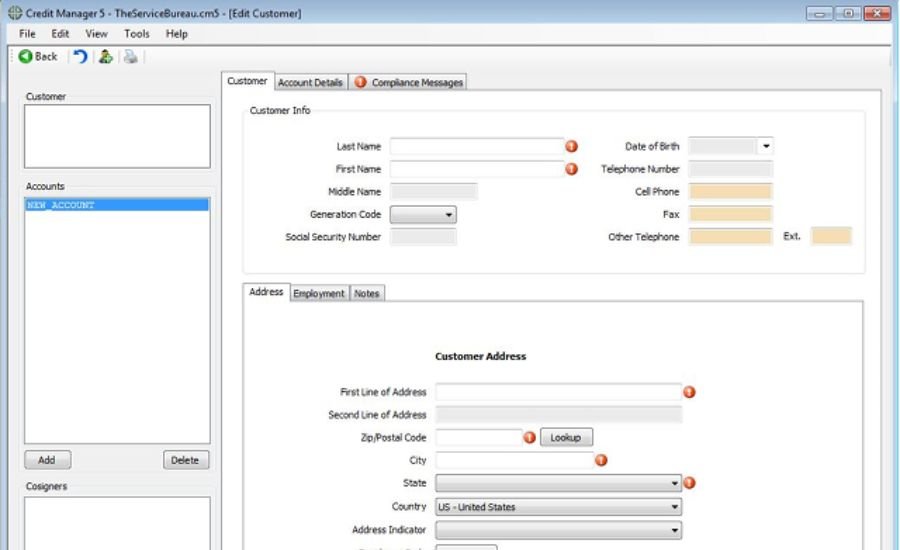

Choosing the right Metro 2 depends on business needs. The business should consider using automated data validation and compliance tracking applications. Make sure that the software you choose integrates seamlessly with the existing systems for financial management that have user-friendly interfaces and the ability to provide customer service as a top priority. Some Metro 2 options come with cloud-based capabilities, providing flexibility and easy access to data. Businesses should evaluate different software options to find the best fit for their requirements.

Popular Metro 2 Software Options

Several Metro 2 options are available in the market. Some popular choices include Credit Manager, e-OSCAR, and Metro 2 Compliance Reporter. These software solutions offer various features, such as automated data validation, secure reporting, and compliance tracking. Businesses should evaluate these options based on their requirements and budget. Selecting an effective Metro 2 solution can increase credit reporting accuracy and efficiency while making this process seamless and error-free.

Common Challenges in Using Metro 2 Software

While Metro 2 offers many benefits, businesses may face challenges in implementation. Some companies struggle with data integration, mainly if they use multiple financial systems. Others might require training to use the software effectively, and ensuring compliance with relevant regulations can also present difficulties. However, most Metro 2 providers offer customer support and training resources. Businesses can overcome these challenges by using proper training and choosing software with strong support options.

Future Trends in Metro 2 Software

The future of Metro 2 is promising, with advancements in automation and AI. New features like real-time reporting and predictive analytics are being integrated into Metro 2. These innovations will further improve accuracy and efficiency in credit reporting. Cloud-based Metro 2 solutions are also becoming popular, allowing businesses to access data from anywhere. As technology evolves, Metro 2 will continue to improve, providing businesses with better tools for credit data management.

Conclusion: Why Metro 2 Software is a Must-Have

Metro 2 is an essential tool for businesses that report credit data. It ensures accuracy, compliance, and efficiency in credit reporting. With its advanced features, Metro 2 software reduces errors and improves data security—businesses using Metro 2 benefit from streamlined reporting processes and improved relationships with credit bureaus. Investment in Metro 2 can assist companies in maintaining accurate credit records and avoiding compliance issues. Furthermore, data reporting becomes even more efficient and reliable as technology evolves.

Read You Have To Know: Compass-Software

FAQs

Q: What is Metro 2 software used for?

A: Metro 2 software is used for accurate and standardized credit reporting to major credit bureaus.

Q: Who can benefit from Metro 2 software?

A: Banks, lenders, credit unions, collection agencies, and mortgage companies benefit from using Metro 2 software.

Q: How does Metro 2 software improve credit reporting?

A: It automates data validation, ensures compliance, and minimizes reporting errors, improving accuracy.

Q: Is Metro 2 software compliant with industry regulations?

A: It follows CDIA guidelines and adheres to regulations like the FCRA and GLBA.

Q: Can Metro 2 software integrate with other financial systems?

A: Yes, most Metro 2 software options offer integration capabilities for seamless data management.